Length of rental (LOR) for collision-related rentals declined in the final quarter of 2024, which continued a trend compared to 2023, but is still higher than pre-pandemic levels, according to Enterprise, which tracks LOR data.

While the declining LOR is encouraging as the collision repair industry enters 2025, other challenges remain, Enterprise pointed out, including encouraging new talent to enter the industry and rising severity meaning more vehicles being deemed total losses, which in turn reduces claim counts. Economic factors may also influence customer behavior, such as claim filing aversion due to increased deductibles and higher premiums.

Overall LOR

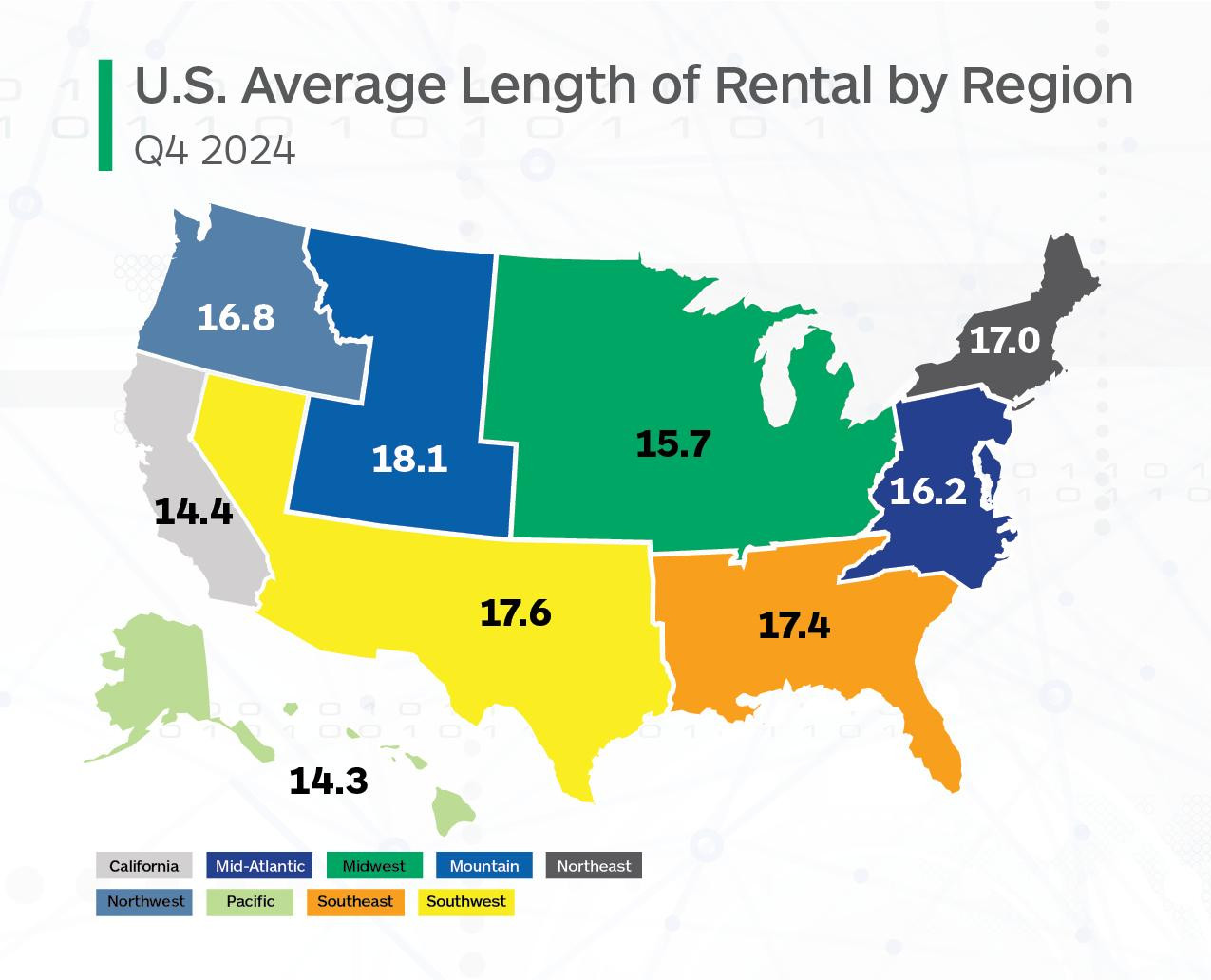

Overall LOR in Q4 2024 was 16.5 days, a 1.3-day decline from Q4 2023. This is on the heels of the one-day drop that Q4 2023 saw from Q4 2022.

This is the second quarterly year-over-year decline in a row, as Q4 LOR in 2022 -- 18.7 days -- was an increase of 1.7 days from Q4 2021’s 17.0 days, which was a 3.9-day increase from Q4 2020, when overall LOR was 13.1 days.

West Virginia had the highest LOR in Q4 2024 at 19.9 days, closely followed by New Mexico at 19.8 days and Colorado and Rhode Island, both at 19.6 days.

Washington, D.C., and North Dakota had the lowest LOR, both at 11.6 days. The next-lowest states were Hawaii (12.8) and Iowa (13.4).

Only two states had increases in Q4 2024 compared to Q4 2023: Nebraska up 1.9 days and Vermont up 0.2 days.

Graphic via Enterprise.

Graphic via Enterprise.

D.C. had the largest decrease of 2.9 days, while Idaho and Minnesota saw declines of 2.3 days. Seven additional states had declines greater than two days, with an additional 22 states recording a decline of one full day or more.

“The total aggregate weekly hours worked in the collision industry were at near-record levels at the start of Q4 2024, thanks to a historically high total number of production employees,” said John Yoswick, editor of the weekly CRASH Network newsletter and an Autobody News contributor.

The U.S. Bureau of Labor Statistics calculates total aggregate weekly hours by multiplying the total number of production employees in the industry by the average number of weekly hours worked. Yoswick said there were 246,000 production workers in the industry in October 2024 -- that number never exceeded 229,000 in pre-pandemic years.

“That larger work force is helping churn through the work, putting in a combined 9.4 million hours per week, higher than the pre-pandemic record of 8.7 million hours in June of 2017,” he said.

Along with a decline in overall claims counts, the large workforce helped bring the average backlog of work at shops nationwide down to 2.1 weeks in October 2024, half a week lower than the average in July 2024, Yoswick said.

“Not since 2020 had the average fourth quarter backlog been shorter than 2.1 weeks,” Yoswick said. “About 16% of shops reported having no backlog of work this past October, comparable to 2019, a figure that had fallen well below 10% for much of 2022 and 2023.”

Ryan Mandell, director of claims performance for Mitchell International, said the average first-party deductible amount was also higher year-over-year in Q4 2024 -- $803 compared to $755 in Q4 2023 -- likely indicating that consumers are struggling with premium affordability.

“Increasing deductibles also indicate that there is a reduced likelihood to file first-party claims since it takes a higher amount of damage to justify paying a higher deductible, along with concerns about further premium increases,” Mandell said.

Mandell noted the Q4 2024 average deductible was down compared to the previous quarter -- $827 in Q3 2024.

Also likely helping to speed up production, Yoswick pointed out, is an improved parts supply chain.

“Just over half (52%) of shops participating in a CRASH Network survey in December 2024 said they were having fewer parts challenges than they were a year earlier,” Yoswick said. “Another 27% said parts issues at least hadn’t gotten worse.”

Because replacement parts have such a large impact on cycle time, Enterprise asked Greg Horn, PartsTrader’s chief industry relations officer, if the quarter-over-quarter reductions align with PartsTrader’s median delivery days, plus two standard deviations to capture 95.5% of the parts delivery performance.

Horn noted, “West Virginia, New Mexico, Colorado and Rhode Island all had Q4 2024 median delivery days that were higher than the U.S. median of 9.4 days. This aligns with the higher LOR found in the Enterprise data.

“The mild early winter of Q4 2024 had an influence on the decrease in delivery days, although the storms of January 2025 could impact days for Q1 2025,” Horn added.

Drivable LOR

Drivable LOR in Q4 2024 was 15.2 days, a 0.8-day decline from Q4 2023 (16.0). This follows the 0.2- day drop in Q4 2023 compared to Q4 2022 (16.2 days).

When compared to Q4 2021, when LOR was 14.5 days, LOR is 0.7 days higher. For further comparison, drivable LOR in Q4 2020 was 11.3 days.

Colorado had the highest LOR at 18.7 days, followed by New Mexico (18.5 days) and Rhode Island (18.3 days).

North Dakota had the lowest drivable LOR at 10.1 days, with D.C. at 10.8 days and Hawaii at 11.2 days.

As with the overall results, Nebraska had a large drivable LOR increase of 2.6 days with Vermont seeing a 0.9-day increase, followed by Missouri, up 0.8 days. Six additional states also had modest increases.

D.C. had the largest decline of 2.2 days, followed by Minnesota down 1.9 days. 14 additional states had declines greater than 1 day.

Non-Drivable LOR

Non-drivable LOR was 22.1 days in Q4 2024, a 2.6-day decline from Q4 2023. Non-drivable LOR was 27.1 days in Q4 2022, and 24.3 days in Q4 2021 -- which saw a jump of 3.2 days from Q4 2020’s results of 19.0 days.

West Virginia had the highest non-drivable LOR at 28.3 days, with Alaska close behind at 28.2 days. Three other states (NM, CO, and SC) had nondrivable LORs greater than 25 days.

D.C. had the lowest non-drivable LOR at 15.0 days, with the next-lowest states of North Dakota (18.8), Iowa (19.2) and Minnesota (19.6) the only other states lower than 20 days.

Nebraska and Alaska both had non-drivable LOR increases of 0.8 days.

D.C. had the highest decrease of 7.1 days, followed by Washington (-7.1 days), North Dakota (-5.1 days) and Minnesota (-5.0 days). Thirty-seven additional states had decreases of 2.0 days or greater.

Total Loss LOR

LOR for rentals associated with a total loss claim was 14.7 days in Q4 2024, a 1.6-day decrease from Q4 2023. Q4 2024’s results are the closest to results last seen in Q4 2020, when total loss LOR was 14.0 days.

West Virginia had the highest total loss LOR at 17.8 days, followed by New Mexico at 17.5 days and Maine at 17.0 days.

The lowest total loss LOR was North Dakota at 11.7 days, followed by South Dakota at 12.2 days.

No states had total LOR increases.

Alaska (-4.4 days) and Wyoming (-4.0 days) had the largest decreases; eight states had decreases greater than three days, while 13 additional states plus D.C. had decreases of 2.0 days or more.

Mandell said total loss frequency increased to 23.3% in Q4 2024 -- up from 20.8% in Q4 2023 -- which is the highest number recorded in the last five years.

This number was driven primarily by falling used vehicle values coupled with continued rising repairable severity.

“While catastrophe losses occurred in the Southeast U.S., they do not appear to have had a marked impact on this number,” Mandell said. “Greater total loss volume means fewer vehicles entering collision repair facilities, further driving down backlogs and work in process.”