As collision repairers deal with the “double whammy” of both part prices and the number needed to finish a job continuing their steady increases, looming strikes at East Coast ports and a German union threaten to add to their woes in 2025 by increasing delivery times.

Greg Horn, chief information officer for PartsTrader, spoke to Autobody News about the company’s latest colllision repair parts delivery trend report, ahead of its official release Nov. 5, the first day of the 2024 SEMA Show.

The Q3 2024 report shows the average number of parts quoted per job has increased from 5.3 in 2020 to 7.4 in 2024 for passenger cars, and from 4.5 to 6.3 parts in trucks and SUVs.

“We're seeing the proliferation of accident avoidance systems, the bumper sensors,” Horn said. “That's really what's fueling the increase in the number of parts for both passenger cars and SUVs.”

Meanwhile, the average part price by part type shows new OEM parts -- which steadily make up 70% to 80% of parts used on a typical job, whether the vehicle make is domestic, Asian or European -- has increased from $432 in 2020 to $579 in 2024.

In the same timeframe, aftermarket parts’ average price increased from $260 to a current average of $316, though that is down from its peak of $330 in Q1 2023.

Remanufactured parts -- mostly alloy wheels -- had the largest average price increase over the past four years, spiking from $289 to $468. More than $60 of that increase came in the last year alone, the largest increase year-over-year of any part type.

Horn said there are two trends contributing to the increase in prices for remanufactured alloy wheels.

One, the wheels are getting larger. “Seventeen (inches) used to be the standard wheel on SUVs. Now you're seeing 18-, 19-inch wheels. More material has to be removed by the reconditioning technicians,” Horn said. And two, there’s a shortage of technicians qualified to work on those wheels.

“When people in the insurance and collision repair industries talk about inflation, they usually talk about it on a part-level basis, so it's a double whammy for this industry,” Horn said. “It's the number of parts as well as each one of those parts going up in price.

“And that’s the cumulative effect, because parts are the biggest portion of a repairable estimate,” he said. “Labor is a close second.”

Median Part Delivery Days

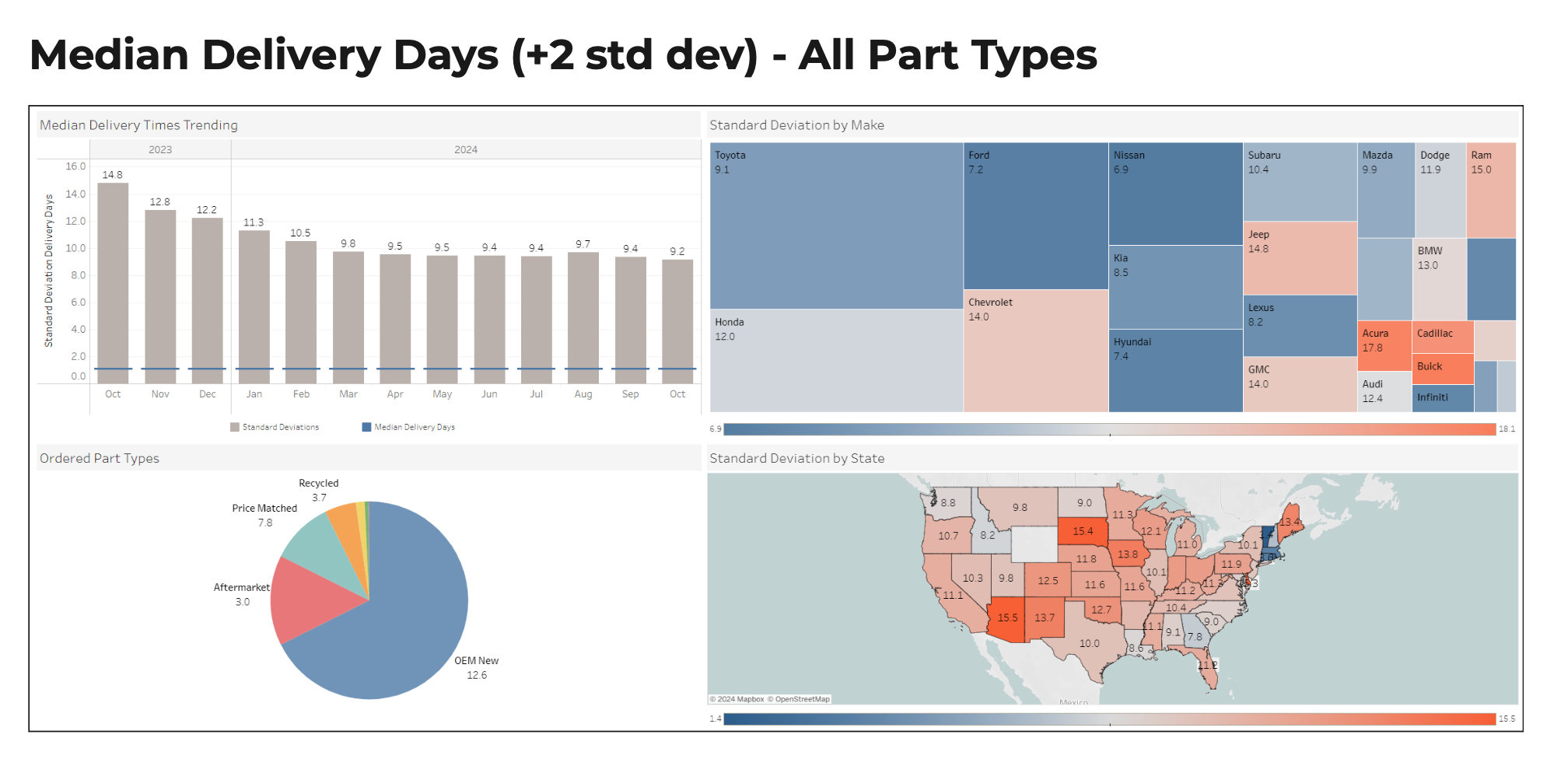

On the bright side, the median number of days needed to receive all collision repair parts for a job is declining -- down to 9.4 in Q3 2024 -- despite a brief interruption at several U.S. ports in early October and severe weather events.

Image via PartsTrader.

Image via PartsTrader.

PartsTrader looks at both the simple average and the median plus two standard deviations, which better takes into account the “outliers” -- for instance, when nine out of 10 parts arrive in a day and a half, but the 10th is backordered.

The median has been steadily decreasing since October 2023, when the UAW struck against the Big Three, driving it up to 14.8 days.

“[UAW President] Shawn Fain is a brilliant tactician,” Horn said. “He took the minimum amount of people to do these wildcat strikes at part distribution centers, knowing that was the area that the vehicle owner, as well as the franchise dealer, would feel the biggest pain. And you see that spike in in OEM parts. Now it's down to 9.4 days, which is great.”

Horn said that was the effect analysts were expecting on aftermarket parts when the International Longshoremen’s Association (ILA) struck in early October, but advance planning minimized it. Those parts averaged 2.5 delivery days in Q3 2024.

“It was well known that Oct. 1 was the date [the strike would begin], so those shipments were diverted to the West Coast,” Horn said. “They had to be trucked, so there's a delay in getting them to the distribution centers.”

Aftermarket parts aren’t as susceptible to spikes in delivery days, Horn said, because suppliers tend to keep a lot in stock.

Even if the port strike had a greater effect on aftermarket parts, Horn said the median delivery days are always driven by OEM parts.

“They’re still the biggest portion of the estimate. They are still the biggest potential for an outlier, because it’s a trim piece,” he said.

Price-matched parts -- when a dealership sells an OEM part at a loss to either match the aftermarket alternative or undersell another dealership in the hopes of winning a shop’s regular business -- had a median of six delivery days, more than double that of aftermarket parts.

Horn said that tells him body shops are willing to wait the extra days to get an OEM-quality part at a lower price to protect their margins.

Parts Delivery Challenges Ahead

Potential strikes could disrupt the collision repair parts supply chain.

The ILA strike at 10 East and Gulf coast ports temporarily ended with a contract extension, but it could resume Jan. 15, 2025, if negotiations to finalize a new contract fall through.

“There has been no movement on the biggest sticking point, which is the pledge for no further automation,” Horn said.

The strike was initiated after an Alabama port violated the union agreement by implementing automated gate checks to inspect cargo and confirm the bill of lading matches the contents.

“Ports are a big security threat to the U.S. in general, so automated gate checks are more secure. There are no possibilities of human error,” Horn said.

Automated gate checks also cut down on the chances of smuggling everything from counterfeit watches to knockoff drugs.

“That is actually quite common,” Horn said.

Automating that task affects, on average, about 25 people’s jobs at a port the size of the Port of New Jersey, Horn said, so it’s a “small percentage of workers,” but the union is concerned automation will further spread to other parts of the process.

Strikes could also affect automakers.

In the U.S., the UAW is threatening walkouts at Stellantis facilities, as the company struggles to address declining sales, high frequencies of warranty claims, and its obligation in the contract it signed in 2023 with the UAW to reopen the Belvidere, IL, assembly plant. This could lead to disruptions in the supply of collision parts for Stellantis vehicles.

In Germany, Volkswagen’s announcement that it is considering closing factories there for the first time in its history, citing high energy and labor costs, has sparked tension with the IG Metall union.

The union has threatened a strike at all German VW factories if any plants are closed, and is demanding the reinstatement of a 35-year job guarantee recently eliminated by Volkswagen.

Horn said VW produces a lot of parts in Mexico, but the bigger potential threat for collision repairers in the U.S. is that IG Metall has a history of “sympathy strikes,” which could halt parts production for other German automakers like Mercedes-Benz and BMW.

“I lived in Germany, and IG pretty much shut down production to argue for a 37.5-hour work week ages ago. And they brought most production to a standstill,” Horn said.

The report said the situation in Germany “remains tense.”

The full report will be available Nov. 5. PartsTrader will have complimentary print copies available to SEMA Show attendees at Booth #33215 in the Collision Repair & Refinish section in South Hall Upper.

Abby Andrews