A recent CIECA webinar presented by PartsTrader and the Insurance Institute for Highway Safety titled “The Collision Impact: How Vehicle Trends Are Shaping the Industry” brought forth significant insights into subjects like impending tariffs and the impact of vehicle weight in collisions.

PartsTrader Chief Industry Relations Officer Greg Horn introduced the topic of tariffs with an overview slide. He referenced rapidly changing government policy as he introduced his jumping-off points.

“I don’t think I’ve ever revised a slide as much in my life as I have with this slide,” he said.

Tariff Concerns

President Donald Trump, Horn said, has allowed for a 30-day exception for automakers that comply with the USMCA, meaning their cars must have 75% domestic content to be exempt from the tariff.

Proposed tariffs on Chinese goods came in at 20% recently. Since the U.S. doesn’t recognize Taiwan as a sovereign nation, Horn pointed out, the same tariffs would likely apply to Taiwanese goods. There would likely not be an exception for auto parts, he said.

Canada, he said is a significant automobile producer and a large exporter by value of vehicles. Some parts, he pointed out, cross the Canadian borders to sub-assembly plants as many as seven times before becoming part of a finished vehicle.

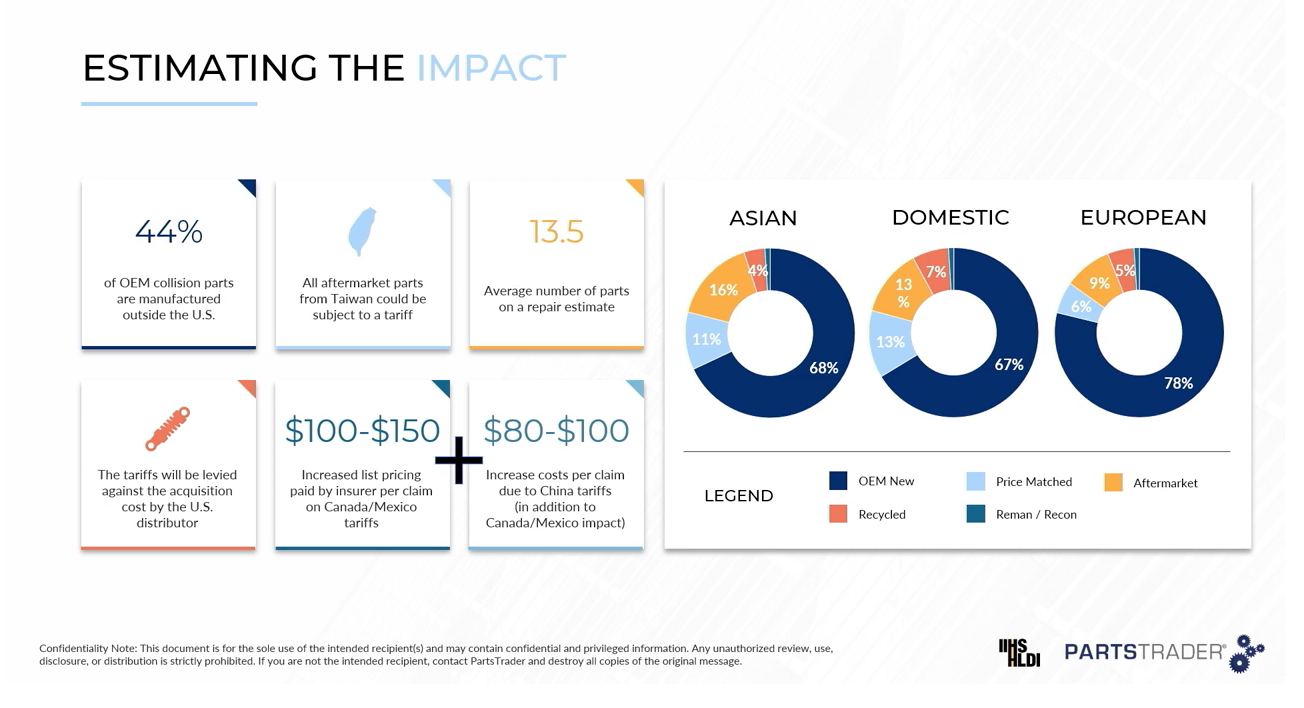

Tariffs could have significant impact on estimate cost.

Tariffs could have significant impact on estimate cost.

“The open question is where does that tariff apply, where does it get levied and how often in that back and forth of seven times does that tariff get levied? The answer is right now we don't know,” Horn said.

Similar questions, he asserted, apply to Mexico in relation to steel that goes into auto parts. Horn mused about the overall impact of tariffs. Some experts, he said, have targeted aftermarket parts as the most-affected subset here, but a significant percentage of OEM parts are manufactured outside the U.S. Tariffs levied against cost of acquisition could drive increases of $100 to $150 on final estimates for Canadian and Mexican OE parts and $80 to $100 for Taiwanese parts.

Mean Shifting

Matt Moore, chief insurance operations officer with the IIHS, moved on to mean shifting within certain technologies.

He defined the phenomenon through an analogy: “If we all stood up and we measured everyone, we'd get an average height, and then, if we told everyone to step out of the room that didn't play high school basketball … and then we measured again, nobody gained any sort of height but the average would move much higher because we asked the shorter folks to leave the room.”

Rear automatic emergency braking is an example of this situation, because it factors into relatively low-speed crashes, he said, so it’s eliminating lots of inexpensive claims.

A similar thing is happening with other ADAS technologies, like front automatic emergency braking, he asserted. About 30% of registered vehicles in the U.S., he said, have the technology.

“I'm asked why it is that we're not seeing topline frequency reductions associated with this technology which supposedly is so good,” he said. “Over time, as the fleet becomes more and more equipped with the tech, top line frequencies are going to drop even more. Plus the technology is evolving and improving.”

Vehicle Weights and Collisions

The discussion shifted to vehicle weight, which has increased significantly in some models. Horn compared a 1995 extended cab Ford Ranger at 3,400 pounds to the same type of model in 2025 at more than 4,000 pounds.

“From a safety perspective and from an insurance risk perspective, we're very concerned about two things, and it relates to high school physics,” Moore said. “It's weight, and it’s speed.”

More weight generates more force in crashes, he explained. Weights across the board in cars, trucks and SUVs, he said, have been increasing. Some of this extra weight, he contended, is driven by the luxury components that are popular on the market.

All-wheel drivetrains, he said, also add significant weight and are prevalent among newer vehicles, contributing to force and risk of injury in a crash. An uptick in small pickups that began in 2014 caused a reduction in weight, but these smaller trucks, he pointed out, are still much heavier than in earlier days.

Electric vehicles, Horn added, are heavier than their gas-powered counterparts, and despite the widely held idea that EV sales will drop if tax credits go away, new innovations like Toyota’s solid state battery could reignite their popularity.

Solid state batteries could significantly reduce vehicle weight, he said. Overall crash risk, he pointed out, revolves around occupied ground space, vehicle length and driver’s seat sight lines. Studies done on ICE vehicles and their EV counterparts revealed lower loss and associated injury risk for the EVs, Horn said.

Turbos and Crashes

Moore also brought up turbocharging, pointing out the 2023 model year population contains nearly 40% turbocharged vehicles; he predicted 30% of the U.S. vehicle fleet would be turbocharged by 2030. The presence of turbo power means slightly higher severity in crashes, he said.

“There's more componentry in the front end. You've got the intercooler, you've got the turbos themselves, you've got all the plumbing related to them, and on top of that, many new vehicles are also likely to have all-wheel drive drivetrains, so there's just a lot more stuff under the hood,” he said.

Elizabeth Crumbly