An ongoing challenge in the collision industry is improving customer satisfaction and retention following a vehicle accident. In October, CCC Intelligent Solutions released findings from its Moments of Truth study, identifying the key drivers of customer satisfaction and retention in the auto insurance claims and repair process.

The study examined 47 “Moments of Truth” based on data from 2,400 policyholders who had been in an accident between August 2021 and December 2023 and completed the repair process as a first-party claimant.

The study was co-authored by Maryling Yu, vice president of marketing at CCC Intelligent Solutions, and Dr. Ranjini Vaidyanathan, director of CCC’s data science team.

“The study sought to define the critical points in time -- or moments of truth -- in which carriers and repairers must perform well to achieve a good outcome for customer satisfaction, and for carriers, customer retention,” explained Yu.

Autobody News talked to Yu about the study and the implications for insurers and repairers. She will provide an in-depth analysis of the findings during a Dec. 5 CIECA Webinar.

What prompted CCC to conduct the Moments of Truth study?

Prior to joining CCC in 2023, I worked in the financial technology (fintech) sector. Over my career, I have enjoyed sharing insight through proprietary research on outcomes that customers care about.

CCC worked with Magid Research, a prominent market research firm, to collect the data used in the study. Our goal was to examine the connected claims and repair journey.

How would you describe a ‘Moment of Truth?’

A moment of truth is a concept that comes from the service industry. It’s a critical point in time during the customer journey that significantly impacts customer satisfaction and retention.

The outcomes we were studying were the satisfaction scores that consumers give their insurer or repairer after a claim. Typically, they will tell you everything is important, so you need to use statistics and regression analysis to learn what really drives that score.

Some of the moments studied included how consumers perceived communications, the empathy received, and the time it took to repair the vehicle.

What did the research reveal and what were the key takeaways?

Our research showed that during the claims experience, consumer satisfaction with insurers and repairers is closely linked and their collaboration plays a pivotal role in each other's satisfaction scores.

For example, respondents were more satisfied with carriers when they perceived overall vehicle repair quality to be high; they were more satisfied with repairers when they received clear communications about how the claims process would work. This suggests that the entire post-accident journey from “crash to keys” is one unified experience in which the providers are, in some instances, indistinguishable from one another.

The top moment of truth for consumers going through the collision repair process was a detailed explanation of repair needs. The top moment on the insurance side was clear communication about the claims process. Both of those speak to transparency.

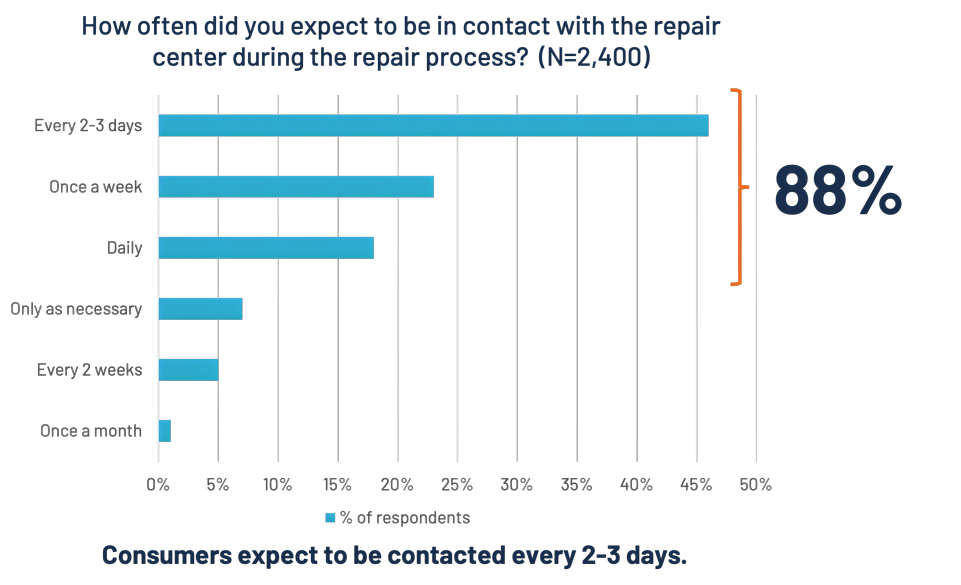

More than 45% of respondents expected to hear from their repair shop every two to three days.

More than 45% of respondents expected to hear from their repair shop every two to three days.

What is truly impactful about this is the industry has long been focused on speed with repairers measuring themselves on cycle times. We found things have shifted. If consumers felt they received a transparent and detailed explanation of repair needs, that was the single biggest impact on the overall score that the consumer gave the repairer at the end of the journey.

The second impactful takeaway is that insurers’ actions help repairers score points. If an insurer clearly communicates about the claims process to the consumer and he or she has a satisfying first contact with the insurance company, those two moments of truth help the repairers score points on the repair satisfaction side.

We also found this to be true when we looked at insurer satisfaction. When high-quality repairs were performed or a consumer was able to get a loaner vehicle from a repair facility, insurers scored points.

This suggests that the process is very intertwined and connected and consumers view the entire process as one experience.

These findings have implications for how insurers and repairers work together to put policyholders at the center of the experience.

What was CCC’s reaction to the findings?

Certain findings were very revealing. The research casts doubt on a long-held belief by insurance claims professionals that customer satisfaction, a metric by which claims teams measure their performance, helps predict customer retention.

We found that most of the moments of truth that helped carriers achieve a positive customer satisfaction score were relatively insignificant in helping to determine carrier defection.

Three moments were the most powerful predictors of switching behavior. In a total loss, the policyholder was upside down in their outstanding loan and was able to cover the gap, the presence of an injury in the accident, and being a first-time claim filer. When all three are present, there is greater than a 3x increase in the likelihood of the policyholder leaving the carrier.

When we presented the findings to the industry and our customers, we found they were surprised. As a technology company that connects 35,000 entities in this industry, we have a unique lens and perspective on what's going on. We want to offer insight to benefit the industry and help our customers achieve better outcomes.

How can repairers and insurers use the findings to improve customer satisfaction and retention?

We suggest insurers and repairers work more seamlessly together and that, in doing so, they focus on transparency. The goal is to find how to provide transparency and speed to customers and utilize technology to achieve this.

On the insurers’ side, we found that repair satisfaction is really important to insurer satisfaction. The more an insurer can ensure a customer has a satisfying repair experience, the happier that customer will be and the higher their satisfaction rating will be. Therefore, my top piece of advice for insurers is to work more closely with repair partners.

I also recommend repairers and insurers understand the three moments of truth that help predict when a customer is likely to defect.

Are there plans to conduct additional studies?

Yes, we’d like to delve further into the moments of truth that are causing technicians the greatest frustrations and potentially conduct future studies focused on the employee experience.

Is there anything additional you would like to share about the study?

If there was anything that I wanted to leave in the minds of a repairer, it would be how to inject transparency if the insurer is not communicating clearly about the claims process.

I think the other moments in the study are also worth exploring. For example, the No. 2 moment of truth was having a satisfying drop-off experience. Repairers need to determine how they want to serve customers and how that translates into the drop-off experience. Do they want to offer a waiting room and refreshments while an estimate is being prepared for the customer, or do they want to offer a loaner vehicle right away?

Overall, the study highlights the importance of interconnectedness and the shared responsibility of carriers and repairers in customers’ minds to get them back on the road, regardless of who is responsible. This underscores the need for a unified, customer-centric approach focusing on configurability, personalization and retention management.

Stacey Phillips Ronak