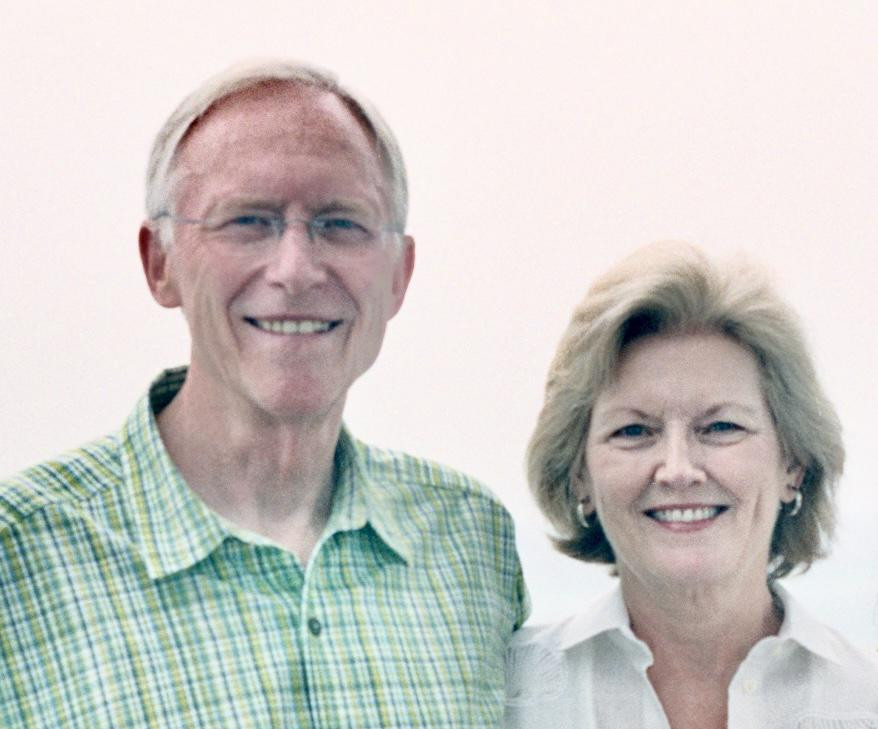

The University of the Aftermarket Foundation (UAF) announced the Prince Family Foundation has become a Lifetime Trustee and will annually award 10 Larry and Sandra Prince Scholarships in memory of the late chairman and CEO of Genuine Parts Company and his wife who steadfastly supported him throughout his career.

Larry Prince had a passion and affinity for the automotive aftermarket. He began his 47-year career with Genuine Parts Company when he was hired for a summer job in June 1958. As his career progressed, Larry became involved in all aspects of the company. In 1959, he married Sandra, who was by his side as he took on roles of increasing responsibility, culminating with a 15-year stint as chairman and CEO of Genuine Parts Company before his retirement in 2005.

“My parents were firm believers in the importance of education and learning as a way to open doors to opportunities and expand one's horizons. Our family is very pleased to support the University of the Aftermarket Foundation and award scholarships in their memory,” said Larry Prince Jr., who will represent the Prince Family Foundation on the UAF Board of Trustees. “My parents would be proud to know that we are helping students pursue careers in the industry that they loved and was so good to our family.”

Ten Larry and Sandra Prince Scholarships will be awarded annually to aspiring students pursuing an automotive career and enrolled in a two- or four-year college or an accredited automotive, collision or heavy-duty/diesel post-secondary program. By completing a single application on the AutomotiveScholarships.com website, applicants will be considered for all scholarships for which they are eligible. The site allows students to view the details of all scholarships available and continue to update their applications until the March 31 deadline.

For information, reminders and updates about the UAF scholarship program, interested parties can text their name and email address to 720-903-2206. The University of the Aftermarket Foundation is a nonprofit organization. All contributions are tax deductible to the extent provided by law.

To learn more, visit UofA-Foundation.org.