The collision repair industry underwent significant shifts in 2024, marked by declining revenues, rising shop closures and rapid consolidation among operators. These trends were the focus of a presentation by David Roberts, founder and managing director of Focus Advisors Automotive M&A, at the MSO Symposium, held in November in Las Vegas.

Roberts said that while the industry is returning to pre-COVID conditions, challenges such as fewer repairable vehicles and increasing vehicle complexity persist.

“To succeed in an industry where complexity and access to repairable vehicles are ever more challenging, operators with scale will continue to grow and thrive,” Roberts emphasized.

Decline in Single Shops, Growth for Larger Operators

Independent single-shop closures reached nearly 800 in 2024, a reflection of declining revenues and intensified competition. Conversely, medium and large multi-shop operators (MSOs) continue to thrive, particularly those with seven or more locations.

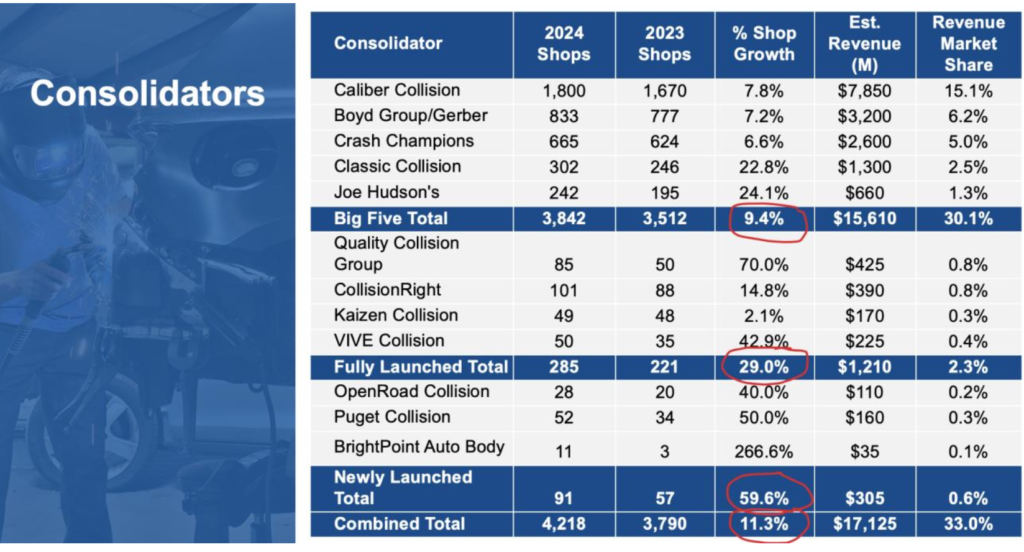

Collision repair shop holdings by consolidators, as of Nov. 1, 2024.

Collision repair shop holdings by consolidators, as of Nov. 1, 2024.

“Independent MSOs with four to six shops -- and especially those with seven or more -- are not just surviving; they’re thriving,” Roberts pointed out.

The consolidation trend is evident in the expansion of major consolidators like Caliber Collision and Classic Collision. Caliber leads the industry with more than 1,800 locations and an aggressive growth strategy that combines acquisitions and new developments. Meanwhile, Classic Collision and Joe Hudson’s Collision Center have each grown their shop counts by more than 22% in 2024, focusing heavily on acquisitions.

Rise of Private Equity-Backed MSOs

Private equity-backed MSOs, dubbed “Sharks” by Roberts, are also gaining momentum. These seven consolidators, including Quality Collision Group and Kaizen Collision, added nearly 100 shops collectively in 2024.

Roberts detailed their financial strategy: “Private equity firms deploy significant capital to acquire smaller operators, improve efficiencies, and achieve substantial returns through enhanced EBITDA and higher multiples.”

Regional MSOs: A Competitive Force

Independent regional MSOs have demonstrated resilience by leveraging unique operational strategies. Examples include G&C Auto Body in California, which scaled from 31 shops in 2023 to 43 as of early November without private equity, and TAG Auto Group in Indiana, which expanded both shop counts and calibration centers.

Roberts commended their entrepreneurial spirit, stating, “It really comes down to the vision of the entrepreneurs and the opportunities they see in their markets.”

Future Challenges and Opportunities

Looking ahead, Roberts anticipates increased pressure on repair margins due to rising labor and parts costs, stricter OEM certification standards, and growing competition for skilled technicians. He predicts consolidators and well-capitalized regional MSOs will dominate the market, achieving more than 50% market share within the next decade.

“The best repairers will need to be super-efficient,” Roberts concluded. “Consolidators and independent regional MSOs with advanced skill sets and certifications will lead the industry.”