Tariffs and strikes are two factors that have the potential to significantly impact the collision industry, and over the past year, the possibilities of those impacts have become more and more apparent.

Industry members learned about these doings and more from Greg Horn, PartsTrader’s chief industry relations officer, during the most recent CIECA webinar held Feb. 6.

Strikes and Settlements

Recent avoidance of strikes has allowed the auto industry and its related endeavors to continue without major interruption. Horn cited the strike the International Longshore Workers Association threatened against the U.S. Maritime Alliance (USMX) recently as “potentially devastating” for the U.S. economy and for mechanical repair and auto collision repair businesses.

In its concessions, USMX, which runs and controls ports on the East and Gulf Coasts, was to step away from a commitment to automate several person-occupied jobs and to honor that decision for the next six years. The two organizations got the deal settled, Horn said, but it will make stateside ports less efficient than other international ports.

A potential strike from IG Metall, the German metal workers union, against Volkswagen resulted in an agreement under a joint framework titled Zukunft Volkswagen (Future Volkswagen).

Volkswagen, Horn said, citing labor costs in Germany as prohibitive, had proposed moving a significant portion of production to South America and China. Instead, the company agreed to trim 734,000 vehicles from German production lines by 2030, a move designed to save €1.5 billion ($1.6 billion) per year. Volkswagen production continued with no shutdown as a result.

Horn also cited a United Auto Workers’ protest last year over delays of restarting of the Stellantis-owned Belvidere Assembly Plant in Illinois.

Stellantis avoided a “debilitating” strike, Horn said, when its then-CEO Carlos Tavares resigned and Dodge Durango production slated to move to Mexico moved to Belvidere. Stellantis, he said, also lowered its U.S. inventory by more than 100,000 units in November and December of 2024 with top-end Jeep Rubicon and Gladiator models discounted up to $17,000.

Horn noted that Cupra brand vehicles, currently in production throughout Europe and Asia, are coming to the U.S. These small to midsize SUVs, he said, are built on an MQB platform -- the same platform that powers most VWs and most Audis. The fact that Cupra is the first planned plug-in electric hybrid vehicle, he said, sets it apart, as other luxury brands don’t offer that option. Tariffs on importing cars from Europe have made Mexico and Chattanooga, TN, attractive sites for the company.

Going deeper on tariffs, Horn did some examination of how the proposed 25% tariff on goods from Mexico and Canada would have affected the collision industry had President Donald Trump not paused it for 30 days.

OEM parts are manufactured outside the U.S. at a rate of 44%, he pointed out. On a repair estimate, he said, the average number of parts needed is now 13.5. Tariffs at this rate could increase list prices from insurers by $100 to $150 per claim. The 10% tariffs on Chinese goods, which did go into effect Feb. 4, could up costs by $20 to $25 per claim, as the tariffs would be levied against acquisition prices for U.S. distributors.

There are eight plants, Horn said, in Canada supplying parts to the U.S. for brands like Ford, Honda, Toyota, Fiat Chrysler and GM. In Mexico, there are roughly the same number of plants supplying parts for those same companies, plus Nissan, Mazda, Volkswagen and Audi.

Stellantis, which produces Jeep and Fiat among numerous others, dodged the biggest bullet with the 30-day tariff hold, he said, as several of its most popular models are produced in those countries and would have been significantly affected by the tariff.

Mergers and Loan Rates

Horn also gave an overview of brand mergers and loan rates. A proposed merger between Honda, Nissan and Mitsubishi to compete against Chinese automakers would have made it the third largest by-volume auto producer.

Talks officially ended the week after the CIECA webinar over disagreements over the structure of the integration, as Honda sought to make Nissan a subsidiary rather than forming a new holding company.

Not every merger goes through, Horn said, and this one might not have made sense given the vehicle-to-vehicle similarities between models like the Civic and Sentra and the Accord and Maxima.

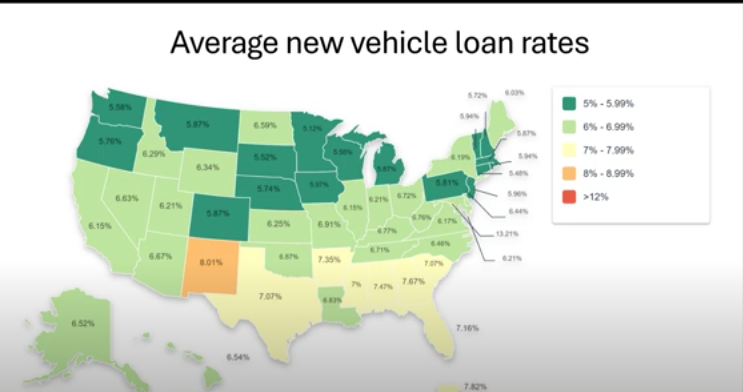

When it comes to loan rates, high rates nationwide can mean vehicle owners can get upside down on cars easily, Horn pointed out. Total loss rates, he asserted, have not come down to pre-COVID levels and remain above 30% for most insurance carriers. Total loss rates plus high interest rates mean total losses take longer and are more difficult to settle.

A significant amount of vehicle owners, he said, owe more than $1,000 per month on the vehicles they drive, so total losses for these people are even more devastating.

Electric Vehicles Update

On the electric side of things, Horn gave an update on Tesla Cybertrucks and the aesthetic issues some owners are running into. Those who try to wrap them, he said, are finding wrap adhesive is reacting with the vehicles’ stainless steel exoskeleton and is permanently etching the surfaces of the trucks. The only option at that point is to rewrap the vehicle, and insurance claims are now rolling in; the industry, Horn said, should watch how they get resolved.

Also of note is the fact that Honda has published developments that set its new batteries apart from what’s currently on the market. Ceramic batteries like the ones Toyota is working on producing with Samsung are safer than lithium ion battery packs, which can overheat or be breached and cause a fire.

Ceramic has yet to be bolted to a test car, Horn pointed out, but Honda is saying its new batteries use ceramic-like electrolytes versus liquid or gel electrolytes. The brand says that with a Level 3 charger, these batteries could get to 80% from below 20% in 10 minutes.

Lighter battery weight, a 630-mile range, little range loss in weather extremes and no significant battery degradation over 10 years are all other benefits, according to Honda, which is aiming for production-ready vehicles in 2030.

Despite the idea that EVs are a phase driven by tax credits, 1.2 million sold in the U.S. last year -- the highest number ever, Horn pointed out. This battery development could move things forward even farther, he said.

“It’s not really a phase,” he said. “But I think there needs to be a next step in the development of EVs, and I think this is the one.”

Elizabeth Crumbly