Initial estimates prepared by insurance company staff are becoming increasingly rare for direct repair claims, according to data shared by CCC Intelligent Solutions at the MSO Symposium in Las Vegas during SEMA week.

As recently as 2017, insurance adjusters were writing more than 40% of initial estimates for repairable vehicles. In the first nine months of 2024, they wrote less than half that -- just 18% of such estimates.

The data, presented by Kyle Krumlauf, CCC’s director of industry analytics, showed more than 45% of initial DRP estimates in 2024 were prepared at shops. That’s almost a full percentage point higher than in any recent year, when DRP shop appraisals comprised between 37.4% (2018) and 44.2% (2021) of the overall total.

Over the same time period, virtual/photo estimates have grown from less than 1% of claims volume in 2016 to more than 1 in 4 (25.6%) in 2024.

CCC data shows insurance personnel are writing far fewer of the initial estimates for DRP claims.

CCC data shows insurance personnel are writing far fewer of the initial estimates for DRP claims.

Shops using CCC’s Open Shop system may have seen an increase in claims volume as well, with more than 8% of initial estimates CCC processed each year since 2022 going through Open Shop, up from between 5.1% and 6.7% in prior years.

It likely won’t come as a surprise to most shops that total losses have been up significantly in the first nine months of 2024.

“One of the most influential factors over the past few years within the collision repair industry and also within the insurance space has been the large shifts in vehicle values,” Krumlauf said. “Vehicle values increased significantly in 2021 and especially in 2022, leading to fewer total losses and more heavier-hit vehicles being repaired. We’re now on the other side of this, and while used vehicle wholesale and retail prices continue to recede, the value decreases appear to be slowing.”

CCC data shows total losses accounting for 21.2% of non-comprehensive claims in 2020, before falling to 19.2% in 2022, but rising to 20.8% in 2023 and 22.4% this year through the third quarter of 2024.

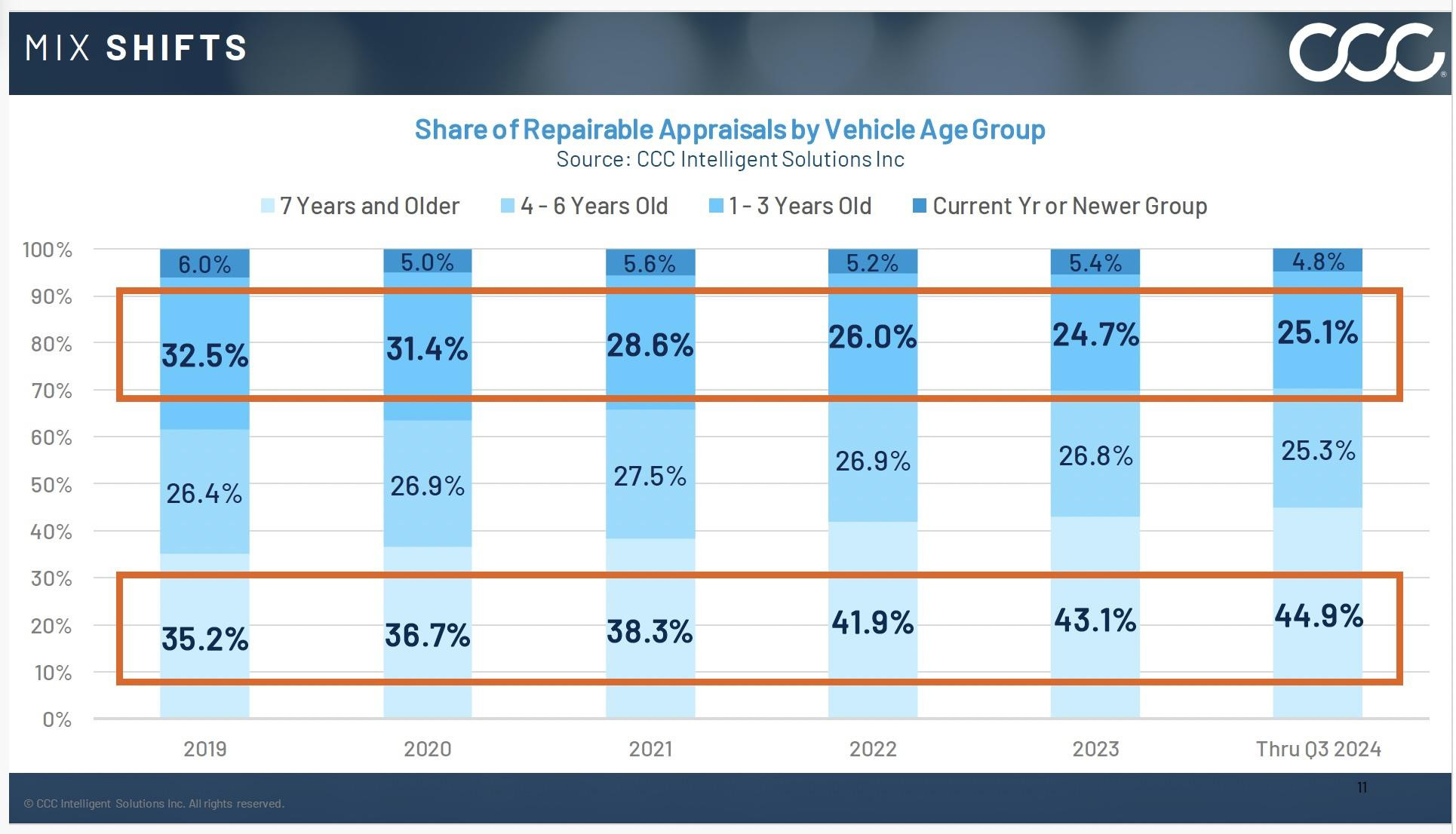

Krumlauf said the age of the vehicles in operation is also really showing up in claims data as well.

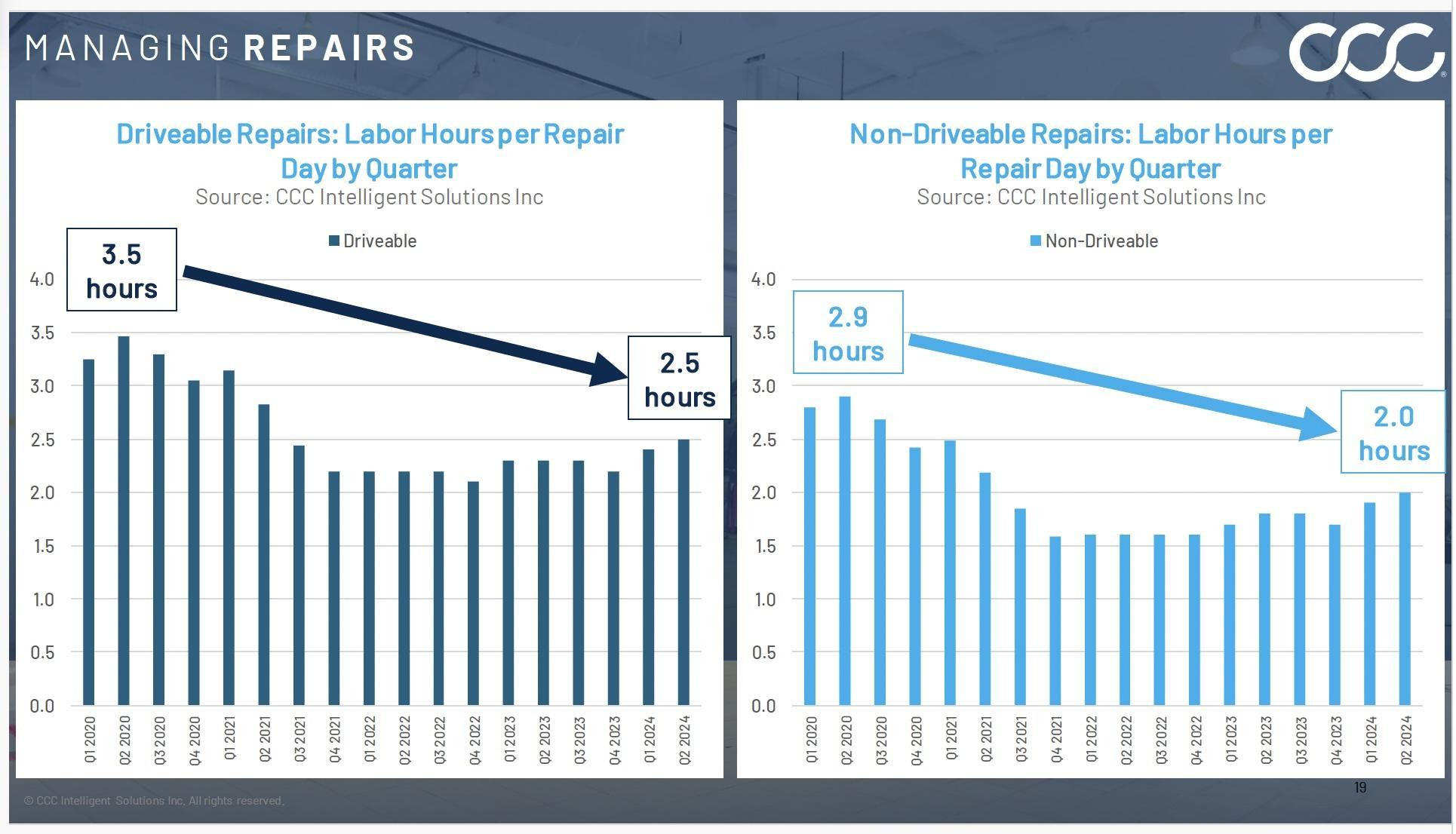

Hours produced per repair day by shops remain below what they were three years ago.

Hours produced per repair day by shops remain below what they were three years ago.

“Maybe the most relevant [claims] mix shift, at least in my eyes, over the past few years has been with our aging car [population],” Krumlauf said. “Vehicles seven years or older represented 35% of repairable claims in 2019. They now represent close to 45%, almost a 10 percentage point increase. On the other hand, vehicles 1 to 3 years old represent over seven percentage points less in the repairable mix. Now, much of that can be attributed to the fact that there were simply fewer vehicles produced and sold for those model years, especially between 2020 and 2023.”

Another trend Krumlauf highlighted is the decline in shop labor hours produced per repair day for direct repair program (DRP) claims.

“What we can see is that this is down about one hour overall for drivable claims, although it is starting to come up gradually, as well as down about 0.9 hours per repair day for non-drivable vehicles,” Krumlauf said. “The question is really why is this? And I think it’d be easy to point fingers here, but I think we need to delve a little bit deeper and understand why that is.

“First, let’s take a look at diagnostics,” he continued. “About 83% of all repairable appraisals through a DRP shop now include a scan, and about 24% of those include some form of calibration.”

Krumlauf said the rise in the average number of supplements -- and the length of time it takes for insurers to approve those supplements -- could also be contributing to the decline in labor hours produced per day.

John Yoswick