All of us have probably seen articles in the collision and insurance industry trade press and even in our everyday media about the increase in auto insurance premiums in the past couple of years.

“The rise in car insurance rates hit a four-decade high in October, reaching nearly 20% annually, even as overall inflation cooled,” an article posted on the insurance shopping website Jerry earlier this year stated. “There is plenty more pain ahead for American drivers. Car insurers are still playing catch-up with rate hikes.”

There is also a lot out there talking about how much a driver can expect his or her cost of insurance to rise after a claim.

“Insurance premiums may increase by as much as 45% or more if you’ve had an at-fault accident,” an article on the CARFAX site stated late last summer. “An at-fault accident raises the average price of car insurance by 49% to $2,930 a year for full coverage, or $244 a month,” an article on LendingTree stated. “For comparison, drivers with a clean record pay an average of $164 a month.”

I’ve even seen estimates of increases exceeding 50% or even 70% after a claim.

So given that, a few other related headlines shouldn’t come as a surprise. Autobody News reported last August about a LendingTree survey that found almost 2 in 5 (39%) of U.S. consumers who had experienced an accident or incident opted to pay out of pocket for repairs rather than file a claim.

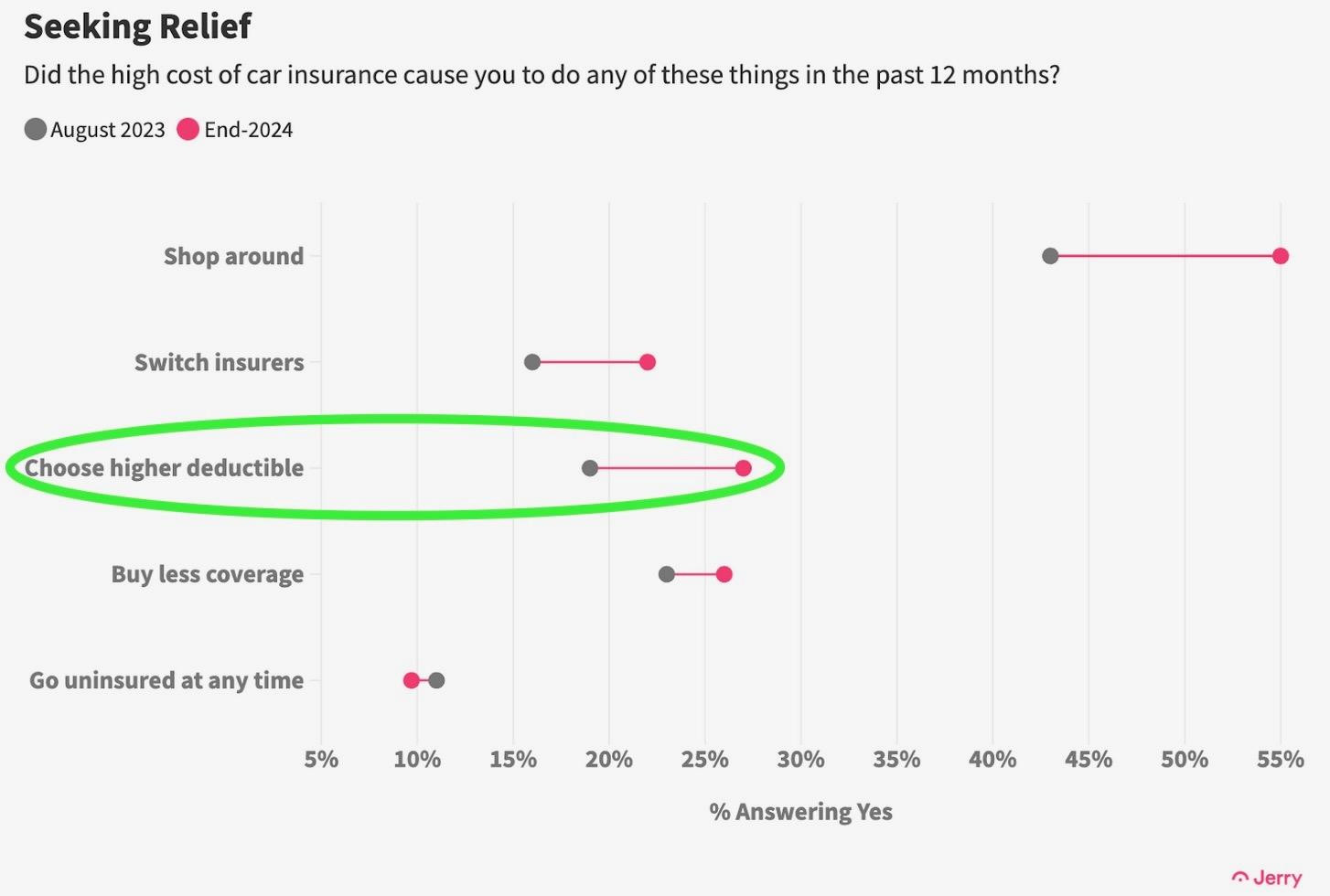

Jerry's 2025 State of the Driver report asked how they are responding to increases in premiums.

Jerry's 2025 State of the Driver report asked how they are responding to increases in premiums.

Even more recently, the Jerry “2025 State of the American Driver” report found that more than a quarter (27%) of drivers have raised their deductible to get a lower rate, and almost an equal percentage (26%) have reduced their coverage in some other way.

With that said, I think we as collision repairers need to be careful not to scare off customers who are thinking about paying for repairs out of pocket. Think, for example, of one of the first things many shops say when to a potential customer after an accident: “Did you file an insurance claim yet, and with what company?” That alone may lead customers to think your shop only deals with insurance claims rather than with customer-pay work.

When I ask shops about whether they’d prefer an insurance claim or a customer-pay job, they almost universally agree they prefer customer-pay work. When the customer is paying, for example, the shop can use all new OEM parts, doesn’t have to wait for supplement approvals, and can get the job through the shop faster and with higher gross profit.

Now, there can be potential downsides with customer-pay work. For one thing, you generally need to avoid a supplement. You can’t easily go back to the customer once you’ve started the job to tell them it’s going to be more expensive than you told them at the start.

But there’s ways to avoid that. Think about how the mechanical side of the automotive repair industry works. If a car gets towed to a mechanical shop or dealership service department because it won’t start, the service advisor doesn’t immediately tell the customer how much it’s going to be to fix the problem. They say it’s going to be X dollars to do some inspections and diagnosis to then determine the cost of repairs.

There’s no reason collision shops can’t do something similar. We can give the customer a broad range of the likely repair cost, but also tell the customer: “Here’s what it’s going to take to do the disassembly and diagnosis we need to do to determine a complete repair plan. If at that point, you don’t choose to have us repair it, we’ll put it back together and you can take it elsewhere.”

Given the potential benefits -- for both the shop and the customer -- of paying out of pocket, I think collision shops should get better at talking about it with customers. Ask them: “Have you considered paying for this yourself rather than going through your insurer, and would you like me to walk you through some of the pros and cons of each option?”

When they do the math of how much their premiums will increase for not just the next year but several years after that, that can make the out-of-pocket costs for repairs seem more palatable. Maybe they have a teenager who is about to be added to their policy which would make the increase even higher moving forward.

The other thing shops can do to help customers pay for their own repairs is to offer financing. The Jerry study this year found that a third of drivers said if they faced a $1,000 repair job tomorrow, they wouldn’t have enough money in the bank to pay for it immediately. That includes 51% of Gen Z drivers, a quarter (24%) of drivers with a household income of between $78,000 and $129,000, and even 11% of those with a household income above $129,000.

That’s why I think shops should consider offering some type of financing option. Two of the most common companies I see shops and dealerships using for this are Sunbit or Synchrony. Yes, your shop will pay a fee for this type of financing, just as you do when you accept payment by credit cards. But often these financing options will enable the customer to pay off the repair over time, perhaps without interest, a huge selling point to many customers.

Stop assuming everyone who walks into your shop would prefer to file a claim to pay for repairs. Stop scaring them away from customer-pay. Start educating them on the pros and cons of both insurance claims and paying out of pocket.

Mike Anderson