Artificial intelligence (AI) is manifesting major applications in writing and verifying both insurance claims and repair estimates in the collision industry.

But while collision repair innovators believe AI increases the agility, accuracy and speed of body restoration, efforts to expand AI in the sector are ramming into an unclear policy landscape and a labor force that fears resultant widespread job loss. From venture capital to AI workforce training to virtual driving assistants, the collision repair industry is witnessing significant investments in AI that propose to increase value for independent shops and original equipment manufacturers (OEMs) alike.

But not all things have been rosy for AI’s recent emergence in the field. As early as November 2021, the collision repair industry was said to be lagging behind other industries in terms of AI adoption, as some technicians around that time had noted AI-powered insurance claim estimates could be inaccurate.

And despite AI’s expansion and promises of efficiency, the average collision repair cycle time was nearly 17 days in 2022, five days greater than pre-pandemic levels, according to a J.D. Power study. The same study found 34% of collision customers preferred working with people over a digital contact. The longer timeframe and human preference both underscore the importance of staffing qualified employees amid a continuing labor shortage in the collision field.

Still, companies that are infusing great time and money into AI in some cases are seeing their efforts pay off. For example, CCC Intelligent Solutions, a technology provider for collision repair shops and insurance companies, claimed an 11% year-over-year revenue increase last year, rising from $782.4 million in 2022 to $866.4 million in 2023. That equated to a gross profit margin of 76%.

New and growing partnerships are allowing repair technology companies like Tractable to expand their AI offerings to a wider user base, according to spokesperson Mitch Anderson. For example, Tractable in 2022 started providing its damage assessment capabilities to Enterprise’s vehicle claim assistance platform Entegral to streamline vehicle repair and replacement rental.

Collision repair technology providers told Autobody News how they are using AI to simplify, streamline and expedite insurance and repair processes.

Because AI use cases are a broad and complex topic, this article touches on only a portion of these companies’ AI-related activities.

While this article examines companies’ specific experiences in using AI, it does not posit that any AI use case is exclusive to a particular company or that any firm’s specific AI capabilities are superior to those of their competitors. Further, AI is a growing technology within collision repair, and there is some crossover in companies’ AI capabilities.

AI Applications in Collision Repair

Chicago-based CCC started its AI efforts about 10 years ago, CCC Vice President of Product Management Mark Fincher told Autobody News. “We're not jumping on the hype cycle with AI; we've been at this for a very long time,” he said.

Over that time, the 44-year-old company has seen its AI-powered software evolve from merely being able to identify damage based on photos, to being able to predict damage costs within a range, and more recently, into a platform that can convert photo inputs into very specific estimates, he said.

The original CCC AI model allowed consumers “to take a few photos, submit those photos, and then have the AI make a prediction of … what the consumer should expect that [repair] to cost,” Fincher said. More recently, in October 2023, CCC launched Mobile Jumpstart in its CCC ONE app. CCC designed the function -- which enables AI-powered creation of initial damage estimates -- specifically for body shops. The human can set the app to automatically accept estimates that clear a certain threshold; for example, if the app reveals a 99% chance a bumper needs replacing, Fincher said.

“The human may look at it and say, ‘Maybe that was prior damage not related to the accident,’ or ‘I'm going to go ahead and repair that bumper versus replace it,’” he said. In that case, “the AI will give predictions on both repair versus replace.”

Another legacy company building out its AI capabilities in the collision repair and estimates realm is San Diego-based Mitchell International.

Olivier Baudoux, Mitchell senior vice president for global product strategy and AI, framed his company’s AI-powered capabilities under four “intelligent” categories of the collision estimate process: photo capture, triage, estimating and review.

Both CCC and Mitchell report their AI shortens the estimate process.

Fincher said his platform can finish 80% of a claim estimating process within two minutes. The full estimate process normally takes about 15-30 minutes, he said.

Baudoux said Mitchell’s estimate creation function pre-populates 70% of the lines of an estimate, on average, significantly reducing the roughly 30 minutes it normally takes to write an estimate.

“Sometimes it will have all of the lines,” Baudoux said. “Sometimes you will have much less lines, but on average, 70% of those lines would be pre-populated by the machine already.”

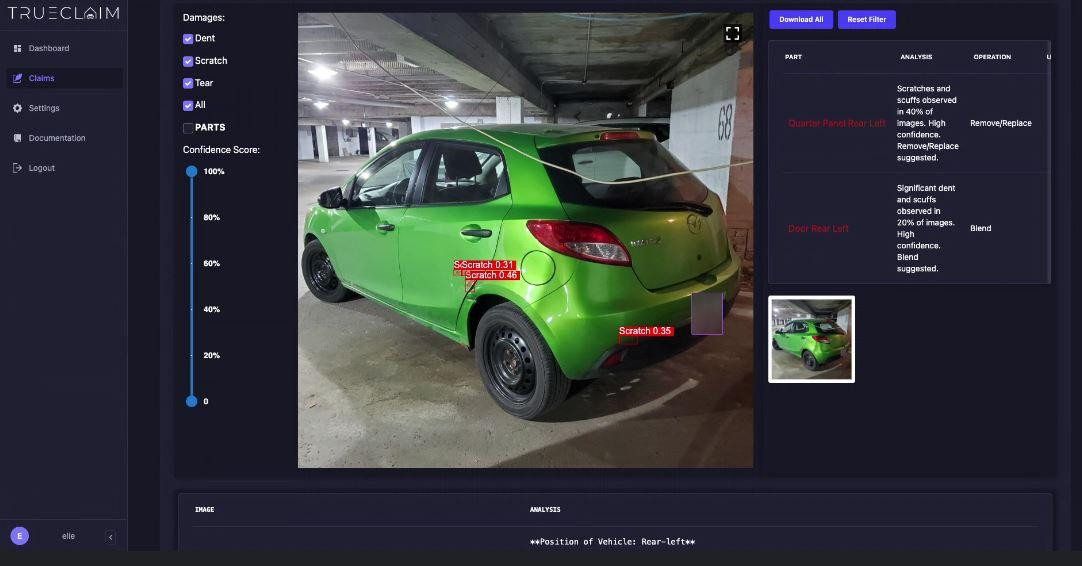

Montreal-based Trueclaim founder and CEO Elie Lloyd said his platform’s AI assists in triaging crashed cars into three categories: fixable with cosmetic damage, fixable with deeper damage and total loss.

Being able to identify a total loss upfront is particularly useful for insurance companies and consumers, Lloyd noted.

“When this accident happens, the car is actually sent to the garage first,” he said. “My system is able to detect in the moment the loss happens that it’s a total loss, so then I save that towing.”

It can take about two weeks to manually adjudicate a total loss, leeching money from insurance companies that must pay for garage space, and unnecessarily occupying shops’ real estate with rattletraps instead of repairable cars, according to Lloyd.

AI in Collision Repair Training

Optimizing the estimate process isn’t AI’s only value proposition in collision repair.

As multi-shop operators continue to onboard new appraisers, they want to ensure the new hires are learning best practices, and may use Mitchell’s review solution, for instance, to coach new hires on critical skills, Baudoux said.

“It's not necessarily about just capturing cost-saving or other opportunities like that,” he said. "It's just about making sure as well that the proper and safe repairs are being enforced, and that they're working with what they consider to be the right discipline and philosophy.”

Fincher noted AI also holds promise both in completing mundane, time-consuming tasks as well as determining optimal workflows based on technicians’ skills.

“There are tons of opportunities to help us as humans combine [natural language processing] with machine learning or large learning models to help that blue-collar technician that is not going to use AI to have a robotic hand come over them and start repairing the car,” he said. “But instead of searching through 20, 30, 40 pages of repair procedures to find the thing they want, maybe they can get to it really quick with a natural language query into repair procedures.”

AI may soon be able to discern the speed that shops swamped with cars can complete repairs if certain damages are assigned to specific technicians who excel in the specific car being repaired, Fincher said. AI may soon help shops determine whether they should “reshuffle” staff as needed to “get everything out 0.4 days faster, or all cars out 1.2 days faster,” he added.

Customer Review Automation

In addition to training, another AI-focused company involved in the collision repair sphere is Newark, CA-based customer review automation platform Propel.

The company uses AI to harness collision repair shop customers’ reviews from platforms like Google, CarWise, Yelp, the Better Business Bureau, Facebook and other platforms, Propel Chief Product Officer Gaurav "Rav" Mendiratta told Autobody News.

From there, the service allows body shops to provide one-click, AI-automated responses to customer reviews on Google, Yelp, etc., tailored to the specific review.

The company has also integrated with CCC ONE, Mendiratta said. As soon as a car logged in the CCC ONE system is picked up, Propel gets notified, at which point Propel automatically texts or emails the customer, via the repair shop, to remind them to review the business on a specified online rating platform.

“We just provide them the link and 30 to 40% end up leaving a review,” Mendiratta said. “Verbally, if you ask a customer [to review], the conversion rate is less than 4%. So, if you ask 100 customers, even though all 100 are happy, four or five will actually end up writing a review. With our software, because of the automation and the reminders, 25 to 35 end up leaving a review.”

Subrogation Claims

Another industry application for AI is assisting in subrogation claims.

New York-based Tractable announced a partnership with PartsTrader in October 2023, which integrated the latter’s historical parts price data into Tractable’s reviewer software.

Tractable said the partnership has enabled insurers to swiftly and accurately review subrogation claims, referring to the adjudication of amounts owed between insurance companies after an accident depending on which party was found liable.

There are typically 13 to 15 automotive parts per repair estimate that need to be checked for price, and it could take two to five minutes per part, Tractable CEO Venkat Sathyamurthy told Autobody News.

“What this means is the time it takes to process the subrogation claim gets longer, and then the claim remains open in the back end,” he said. “When a subrogation claim comes in, we automatically look at the parts that are there and we connect with PartsTrader, and then we improve the speed and efficiency.”

Tractable has trained its AI on more than 500 million images to accurately assess damage, Sathyamurthy said. The company continuously trains its AI on damage identification, in part, by having people tag and label images of damaged cars, and then upload those files into Tractable’s system, he said.

From there, Tractable’s AI continues learning based on the data provided by appraisers and service providers, according to Anderson.

That process is particularly important as new car makes and models roll out, which introduces fresh variables to the damage assessment process.

Where Do the Data Come From?

Data on automotive part types and prices form the backbone of AI’s examinations and recommendations around repair estimates and insurance claims.

Collision repair technology providers glean their data from a variety of sources, sometimes partnering with other companies and other times sourcing from their own repositories.

CCC uses a motor database including all OEM parts, but shops can use the company’s AI to tailor those part selections, drawing from embedded code tables, Fincher said.

“It takes a few minutes, probably three to five minutes to go configure the AI to optimize it,” he said.

Mitchell has compiled OEM and aftermarket part prices and product numbers for nearly 75 years, which provided a sturdy foundation for the company’s AI development, Mitchell Senior Vice President for Repair Sales Jack Rozint told Autobody News.

The company’s database can also distinguish whether used parts are recycled or aftermarket, and Mitchell develops its own labor times, Rozint said.

“We do that by actual time studies where a person from Mitchell sits on a stool at a shop and observes a technician installing a fender on a car, and he comes up with a labor time for that, right from a fender,” he said. “With all of the 25 different OEMs and all the different models that come out every year, [and] the number of parts, you need labor times, not just to hang the part, but then you need a second labor time to refinish a part.”

Though Tractable uses PartsTrader data for parts availability and pricing information in subrogation disputes, Sathyamurthy emphasized his platform itself is, at its core, an open integration platform.

Tractable’s specialization is using AI to provide more accurate damage assessments, working with firms like parts recyclers to understand granular details about parts grading, including whether a part is reusable, he said.

Recyclers may use Tractable to enhance their vehicle purchasing, where Tractable’s AI is combined with in-house vehicle assessment and customer purchasing logic, Anderson said.

“Our goal is to look at a car and identify what is in the car, what the damage is. That's it,” Santhyamurthy said. “We don't have any labor pricing information in any of our systems.”

Tractable Head of Automotive Jimmy Spears said his company’s AI excels at distinguishing car parts from one another and discerning if they are damaged. If parts prices need to be brought in, that can happen through an open process with Tractable’s customers, he said.

After determining whether damage exists, “we can refer to a database and pull in the parking tax,” Spears said. “If you want to know the parts price, get your database, and we'll tell it to you. But what you want to know is, ‘Is that a car?’ ‘Yes.’ ‘Is that car damaged?’ ‘Yes.’ ‘Do you have to repair or replace that part?’”

Industry Perspectives

Skeptical workforce attitudes toward AI are a well-publicized hurdle to development of the technology in the collision repair sphere.

But other challenges facing AI companies in the industry include data privacy and a lack of clear policymaking, executives told Autobody News.

When snapping photos of crashed cars, customers’ personally identifiable information (PII) such as license plate numbers would be uploaded into the system unless there was a built-in protection mechanism, said Trueclaim’s Lloyd.

Further, customers’ names, addresses and phone numbers are naturally part of insurance claims. As a third party in the collision repair process, Trueclaim must be mindful of this when insurance companies or repair shops send claims information to the company, Lloyd said.

“We made sure that it is cleaned up from the partners that we dealt with for this data,” he said. “Before they sent us these data, we had to implement these processes internally for them, so that they send us unidentifiable information. So, before it even crossed the border to our system, it was not identifiable.”

License plate numbers are blurred out as soon as they’re uploaded, for example, Lloyd said.

Policymaking

Another major challenge in AI development and adoption in the collision sphere is a lack of policymaking.

Propel’s Mendiratta would like to see the federal government craft thoughtful AI policy, noting if the task is left to state governments, it could generate winners and losers.

For example, the California Consumer Privacy Act only covers companies of a certain size that do business in the state, he said. Other regional policies like the European General Data Protection Regulation govern all entities that process PII and that also do business anywhere in the EU territory, Mendiratta added.

“If there’s a policy which will put some guardrails around what [AI-developing companies] do and do not do … that would help both professionals and individual users of AI immensely three, five, 10 years down the road,” he said.

Lloyd agreed there is a current lack of policies guiding AI usage. But he added that regulation should treat all AI-focused companies fairly and noted AI’s great potential.

Lloyd compared the current stage of AI development writ large to the internet’s regulation-scarce infancy phase.

“It’s kind of in a baby stage, and nobody really knows how this can be done, how it can be used,” he said. For “everybody that is using AI -- can you guarantee this fairness? That’s really the idea of making policy. Otherwise, if this is not guaranteed, then we’re breaking ourselves.”

Brian Bradley